You might have wondered whether a mortgage falls under the category of personal loans. Well, the answer is yes! While mortgages and personal loans serve different purposes, they share some similarities. In this article, we will explore the relationship between mortgages and personal loans, highlighting their key distinctions and helping you understand how they can both impact your financial journey. So, let’s uncover the fascinating connection between mortgages and personal loans and how they can play a significant role in your life.

Table of Contents

What is a Personal Loan?

Definition

A personal loan is a type of loan provided by financial institutions, such as banks or credit unions, that allows individuals to borrow a certain amount of money for various personal purposes. Unlike other loans, such as car loans or home loans, personal loans are unsecured, which means they do not require any collateral. Instead, lenders evaluate the borrower’s creditworthiness and income to determine the loan amount, interest rate, and repayment terms.

Key Features

Some key features of personal loans include:

- Unsecured: Personal loans do not require collateral, making them accessible to individuals who do not own valuable assets.

- Fixed Interest Rate: Personal loans often have a fixed interest rate, which means the interest rate remains the same throughout the repayment period.

- Flexible Repayment Period: Borrowers can choose a repayment period that suits their financial situation, typically ranging from one to five years.

- Quick Disbursement: Personal loans are known for their quick approval and disbursement process, allowing borrowers to access the funds they need in a timely manner.

Types of Personal Loans

There are several types of personal loans available, each catering to different needs and circumstances:

- Debt Consolidation Loans: These loans are designed to help borrowers consolidate multiple debts into a single monthly payment, often at a lower interest rate.

- Home Improvement Loans: These loans are specifically tailored for renovating or enhancing one’s home, covering expenses such as remodeling, landscaping, or buying new furniture.

- Medical Loans: These loans are used to cover medical expenses, such as surgeries, treatments, or emergencies.

- Wedding Loans: Wedding loans help finance the costs associated with weddings, including venue, catering, decorations, and other wedding-related expenses.

- Education Loans: Designed for students, education loans cover the costs of tuition fees, books, accommodation, and other education-related expenses.

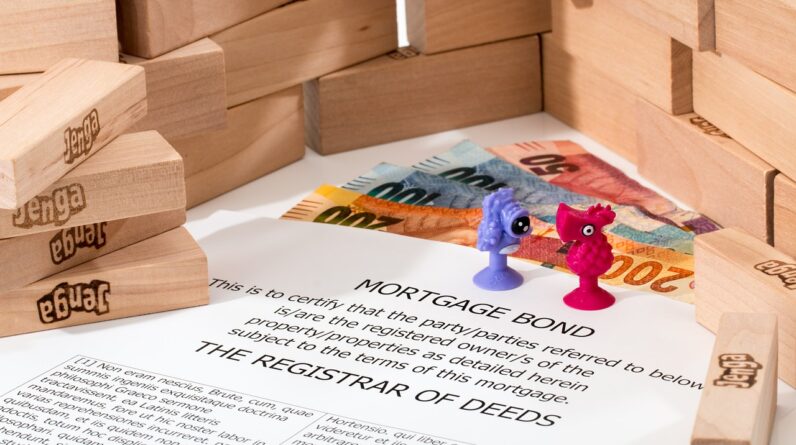

What is a Mortgage?

Definition

A mortgage is a specific type of loan used to finance the purchase of a property, such as a house or an apartment. Unlike personal loans, mortgages are secured by the property itself, acting as collateral for the loan. This means that if the borrower fails to repay the loan, the lender has the right to seize the property to recover the outstanding amount.

Key Features

Some key features of mortgages include:

- Secured: Mortgages are considered secured loans since the property being purchased serves as collateral for the loan.

- Adjustable or Fixed Interest Rate: Depending on the type of mortgage, borrowers can choose between an adjustable or fixed interest rate. Adjustable rates may fluctuate over time, while fixed rates remain constant throughout the loan term.

- Long Repayment Period: Mortgages typically have longer repayment periods compared to personal loans, ranging from 10 to 30 years.

- Large Loan Amounts: Since mortgages are used for purchasing properties, the loan amounts are generally higher compared to personal loans.

Types of Mortgages

There are various types of mortgages available to cater to different needs and circumstances:

- Fixed-Rate Mortgage: This type of mortgage has a fixed interest rate for the entire loan term, providing stability and predictability in monthly payments.

- Adjustable-Rate Mortgage (ARM): An ARM has an initial fixed interest rate for a certain period, after which the rate adjusts periodically based on market conditions.

- FHA Loan: Insured by the Federal Housing Administration, FHA loans are designed for low-to-moderate-income borrowers, offering more lenient credit requirements and lower down payment options.

- VA Loan: Available to veterans, active-duty military personnel, and eligible surviving spouses, VA loans are guaranteed by the Department of Veterans Affairs, providing favorable terms and benefits.

- Jumbo Loan: Jumbo loans are used for purchasing high-value properties that exceed the conforming loan limits set by government-sponsored enterprises such as Fannie Mae or Freddie Mac.

Differences Between Personal Loan and Mortgage

Purpose

The purpose of a personal loan is to provide individuals with funds for personal expenses, such as debt consolidation, home improvement, medical emergencies, weddings, or education. On the other hand, the purpose of a mortgage is to finance the purchase of property, mainly residential real estate.

Collateral

Personal loans are unsecured and do not require collateral. Lenders rely on the borrower’s creditworthiness and income to determine loan approval and terms. In contrast, mortgages are secured by the property being purchased, and the property serves as collateral for the loan.

Loan Amount

Personal loans typically have lower loan amounts compared to mortgages. The loan amount for a personal loan depends on the borrower’s credit score, income, and other factors. Mortgages, on the other hand, are used to finance the purchase of properties, which generally involve larger loan amounts.

Interest Rates

Interest rates for personal loans are generally higher compared to mortgage interest rates. Personal loan interest rates are based on the borrower’s creditworthiness, whereas mortgage interest rates are influenced by market conditions, loan term, and other factors.

Repayment Period

Personal loans have shorter repayment periods, usually ranging from one to five years. In contrast, mortgages have longer repayment periods, typically spanning 10 to 30 years. The extended repayment period of mortgages allows borrowers to spread out their payments over a more extended period, making them more affordable.

Application Process

The application process for personal loans is relatively straightforward and involves submitting an application form, providing necessary documents, and undergoing a credit check. For mortgages, the application process is more complex and involves extensive documentation, including property appraisal, income verification, credit history analysis, and legal procedures.

Approval Criteria

Approval criteria for personal loans mainly focus on the borrower’s creditworthiness and income. Lenders assess credit scores, income stability, and other factors to determine the borrower’s ability to repay the loan. Mortgage approval criteria are more comprehensive and include factors such as creditworthiness, income, debt-to-income ratio, down payment, property appraisal, and legal requirements.

Similarities Between Personal Loan and Mortgage

Borrowing Money

Both personal loans and mortgages allow individuals to borrow money from financial institutions to fulfill their financial needs. Whether it’s for personal expenses or property purchase, both options provide borrowers with the necessary funds.

Repayment Obligations

Both personal loans and mortgages require borrowers to repay the loan amount in installments over a specified period. Regular payments, usually monthly, are expected to ensure the loan is fully repaid as per the agreed-upon terms.

Lenders

Financial institutions, such as banks, credit unions, or online lenders, offer both personal loans and mortgages. They evaluate the borrower’s eligibility, provide the funds, and oversee the repayment process.

Suitability and Usage Scenarios

Personal Loan Suitability

Personal loans are suitable for various situations, such as:

- Consolidating high-interest debts into a single, manageable loan.

- Covering unexpected medical expenses or emergencies.

- Funding home renovations or repairs.

- Financing a wedding or other major events.

- Supporting educational expenses.

Mortgage Suitability

Mortgages are suitable for individuals who:

- Wish to purchase a property, such as a house or apartment.

- Want to invest in real estate.

- Plan to build equity in a property over time.

- Have a stable income and are ready for long-term financial commitments.

Usage Scenarios

Personal loans are versatile and can be used for multiple purposes, depending on the borrower’s needs. Whether it’s to consolidate debts, cover medical bills, or finance a significant life event, personal loans offer the flexibility to meet a wide range of financial requirements. Mortgages, on the other hand, have a more specific usage scenario as they are solely intended for the purchase of property.

Benefits and Drawbacks of Personal Loans

Benefits

- Quick Access to Funds: Personal loans are known for their quick approval and disbursement process, allowing borrowers to access the funds they need in a timely manner.

- No Collateral Needed: As personal loans are unsecured, borrowers do not need to provide any collateral, making them accessible to individuals who do not own valuable assets.

- Flexible Repayment Terms: Borrowers can choose a repayment period that suits their financial situation, allowing them to manage their monthly payments according to their budget.

- Consolidation of Debts: Personal loans can be used to consolidate multiple high-interest debts into a single loan with a potentially lower interest rate, making it easier to manage and pay off debts.

Drawbacks

- Higher Interest Rates: Personal loans generally have higher interest rates compared to other types of loans, such as mortgages or car loans, due to their unsecured nature.

- Limited Loan Amounts: Personal loans typically have lower loan amounts compared to mortgages, which may not be sufficient for larger financial needs.

- Potential Impact on Credit Score: Taking on additional debt through a personal loan can affect your credit score, especially if you miss payments or have a high utilization rate.

- Debt Repayment: Personal loans require regular monthly payments, which can become a financial burden if not managed properly.

Benefits and Drawbacks of Mortgages

Benefits

- Property Ownership: Mortgages provide individuals with the opportunity to own property and build equity over time.

- Lower Interest Rates: Mortgage interest rates tend to be lower compared to personal loan interest rates, allowing borrowers to save money over the long term.

- Long Repayment Period: Mortgages offer longer repayment periods, spreading out payments over several years and making monthly payments more affordable.

- Potential Tax Deductions: In some countries, mortgage interest payments may be tax-deductible, providing potential tax benefits for homeowners.

Drawbacks

- Collateral Requirement: Mortgages require collateral in the form of the property being purchased, which means the property can be seized if loan payments are not made.

- Lengthy Application Process: Applying for a mortgage involves extensive documentation, property appraisal, and legal procedures, making the process more time-consuming and complex.

- High Initial Costs: Mortgages often require a substantial down payment, which can be a financial burden for some borrowers.

- Long-Term Commitment: Mortgages involve long repayment periods, tying borrowers to monthly payments for several years, which may limit financial flexibility.

Factors to Consider When Choosing Between a Personal Loan and Mortgage

Financial Goals

Consider your financial goals and what you hope to achieve with the loan. If you want to purchase a property and build equity, a mortgage may be the better option. However, if you need funds for personal or short-term expenses, a personal loan would be more suitable.

Loan Purpose

Analyze the purpose of the loan. If it is for specific personal needs, such as consolidating debts or funding a wedding, a personal loan would be appropriate. If you are planning to invest in property or buy a house, a mortgage is the more suitable choice.

Credit Score

Evaluate your credit score. Personal loans are often accessible to individuals with a range of credit scores, although higher credit scores typically result in more favorable interest rates. Mortgages may have stricter credit score requirements, and a good credit score is often necessary to secure a favorable mortgage interest rate.

Collateral Availability

Consider whether you have collateral available. Personal loans do not require collateral, making them accessible to individuals without valuable assets. On the other hand, mortgages require collateral in the form of the property being purchased.

Interest Rates

Compare the interest rates for both personal loans and mortgages. Personal loans generally have higher interest rates, while mortgage rates tend to be lower. Evaluating and comparing interest rates can help determine which option is more cost-effective in the long run.

Repayment Capacity

Assess your budget and repayment capacity. Consider how much you can comfortably afford to repay each month. Personal loans often have shorter repayment periods, resulting in higher monthly payments, while mortgages offer longer repayment periods, providing more manageable monthly payments.

Future Plans

Consider your future plans and financial stability. If you anticipate significant life events, long-term financial commitments, or changes in income, it’s essential to factor these into your decision-making process. Mortgages involve long-term financial commitments, so it’s important to ensure you have a stable financial situation to comfortably meet the repayment obligations.

Conclusion

Different Purposes, Different Factors to Consider In conclusion, personal loans and mortgages are both financial tools that allow individuals to access funds for different purposes. Personal loans are suitable for short-term expenses, debt consolidation, and personal needs, while mortgages are primarily used to purchase property and build equity over time.

When choosing between a personal loan and a mortgage, several factors need to be considered. These include financial goals, loan purpose, credit score, collateral availability, interest rates, repayment capacity, and future plans. Evaluating these factors will help you make an informed decision based on your specific financial needs and circumstances.

Whether you ultimately choose a personal loan or a mortgage, always remember to borrow responsibly and consider the long-term implications on your financial well-being.